The mid funnel leak in your portfolio, and the revenue it quietly costs

Many B2B teams are not short on leads. They are short on consistent, relevant follow up when buyer intent is high. The result is a predictable bottleneck between marketing qualified lead and sales qualified lead. If you run platform or value creation, this is one of the cleanest levers to improve growth without buying more demand.

Summary

Across many B2B funnels, MQL to SQL conversion sits in the low teens, and response speed strongly impacts outcomes. Research shows that contacting a lead within five minutes versus thirty minutes can increase the odds of contact by 100 times, and increases the odds of qualification by 21 times. [2][3] For VCs, improving mid funnel conversion is a repeatable portfolio initiative: pick a cohort, standardize the inputs, run a 30 day experiment, and share the playbook across companies.

Playbook in five moves

Quantify the mid funnel leak

Fix speed and relevance

Standardize signals and content

Run a 30 day cohort experiment

Turn wins into case studies

Typical bottleneck: Low teens

First Page Sage reported MQL to SQL rates by industry, with many categories clustering around the low to mid teens.[1]

Speed to lead: 100×

Odds of contacting a lead in five minutes versus thirty minutes in the MIT lead response research. [2]

Buyer access: 17%

Gartner reported buyers spend about 17% of their time meeting with suppliers when considering a purchase. [4]

Why VCs should care about mid funnel nurturing

Mid funnel conversion is a portfolio level problem because it repeats across companies, even when products differ. Many teams invest in pipeline generation, but the handoff from marketing to sales is inconsistent, slow, or generic. That is where revenue is lost.

VCs are uniquely positioned to address it because you can standardize a lightweight operating system across multiple teams: agreed definitions for MQL and SQL, a shared response time target, and a repeatable approach to signals, content, and follow up.

Portfolio symptoms

Pipeline looks healthy, revenue misses targets

MQL volume increases, but SQL volume stays flat

Leads get one touch, then disappear

Sales says leads are low quality, marketing says sales is too slow

Why it is fixable

It is mostly a workflow and prioritization issue

Speed and relevance have measurable impact

Small gains compound downstream

Best practices transfer well across a portfolio

The portfolio math, why small lifts compound

Use this simple model with any B2B portfolio company. Start by looking at MQL to SQL. Many categories sit around the low to mid teens. [1]

A simple example

Input | Baseline | After a small lift |

|---|---|---|

Quarterly MQLs | 1,000 | 1,000 |

MQL to SQL | 13% | 18% |

SQLs created | 130 | 180 |

Incremental SQLs | 0 | +50 |

That is 50 additional sales conversations per quarter without buying additional leads. If the company has even a modest SQL to opportunity and opportunity to closed won motion, these lifts can translate into meaningful revenue.

Why this is getting harder over time

Gartner reported that buyers spend about 17% of their time meeting with suppliers when considering a purchase. [4] That means timing and relevance matter more, because you have fewer chances to earn attention.

Why leads go cold in the mid funnel

When MQLs do not become SQLs, it is rarely because the product is terrible. It is usually a combination of speed, prioritization, and generic follow up.

Slow response

Research shows the odds of contacting a lead in five minutes versus thirty minutes can drop by 100 times. [2]

Inconsistent follow up

Many teams rely on best effort. The lead gets one touch, then the next priority wins.

Generic messages

Buyers expect specificity. Generic nurture gets ignored, even when intent is real.

Harvard Business Review audited 2,241 U.S. companies and found many were far slower than they believed, with an average response time of 42 hours among firms that responded within 30 days, and a meaningful portion never responded. [5]

The takeaway for portfolio companies is simple: if you do not operationalize speed and relevance, you leak demand you already paid for.

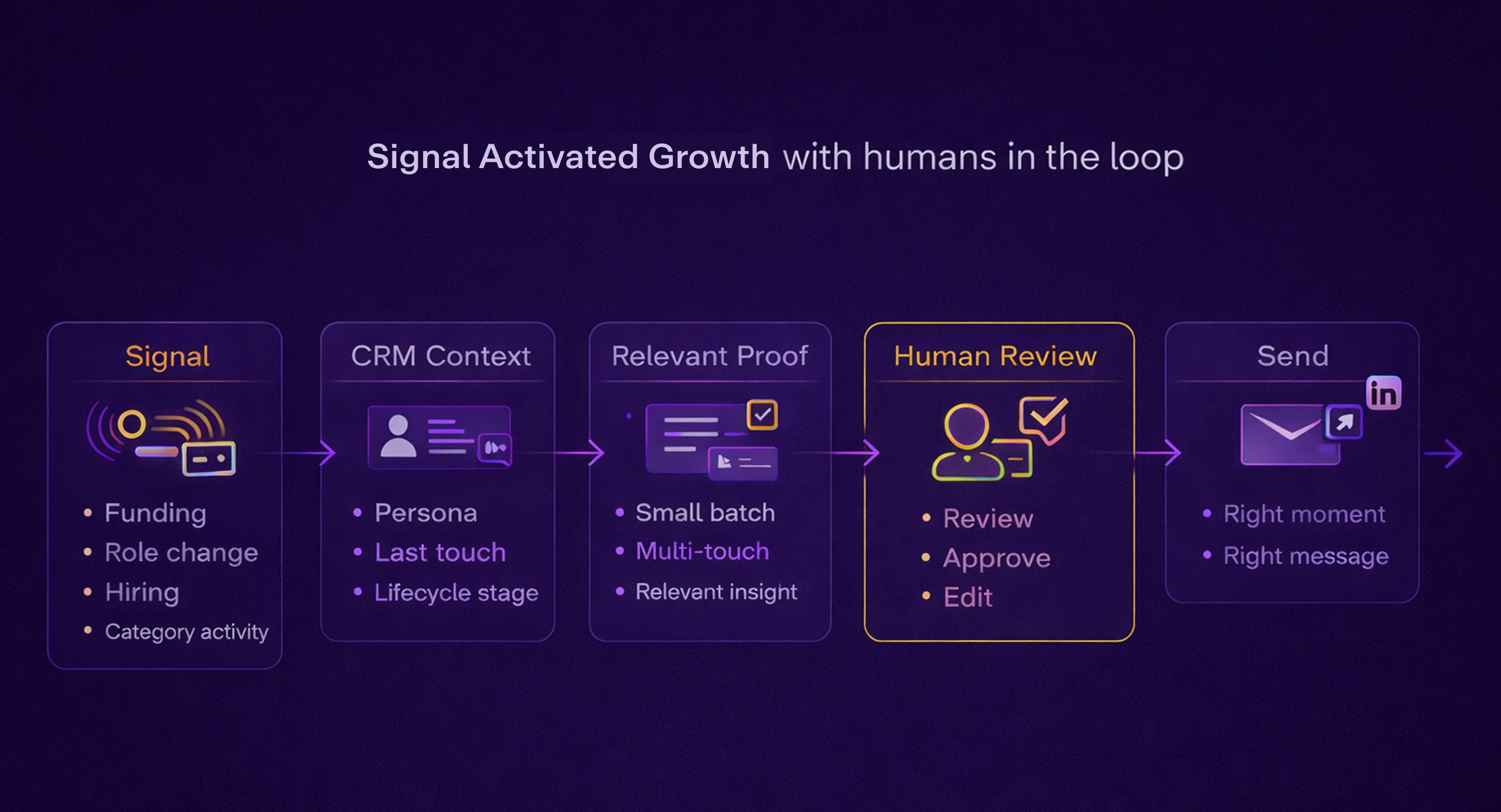

What good looks like, Signal Activated Growth with humans in the loop

Mid funnel nurturing works when it is triggered by a reason to reach out, and when the message matches the buyer’s moment. Think of it as a simple system:

Goal: define the outcome, for example move dormant MQLs into meetings

Signal: a trigger that makes the outreach timely, job change, hiring, funding, category activity

Context: CRM relationship history, persona, last touch, lifecycle stage

Proof: one asset that matches the signal, not a generic brochure

Sequence: small batch, multi touch, with a clear owner

Human review: keep quality, tone, and accuracy high

This is the operating model behind our Lead Nurturing Agent: it watches for signals, drafts contextual follow ups, and keeps a human in the loop for review before sending.

A VC rollout plan that does not create chaos

If you want this to become a portfolio initiative, keep it simple and measurable.

Step | What to do | Output |

|---|---|---|

1. Select a cohort | Pick 3 to 5 B2B companies with pipeline but weak conversion | A focused pilot group with clear owners |

2. Standardize the inputs | Agree on ICP segment, signals, and approved proof assets | A shared playbook that is easy to reuse |

3. Run a 30 day experiment | Trigger outreach from signals, maintain human review, measure lift | A before and after dataset with learnings |

4. Share across the portfolio | Publish what worked, templates, sequences, and guardrails | A repeatable operating system for the platform team |

Metrics to track in every cohort

MQL to SQL conversion rate

Time to first follow up

Replies and meetings booked from dormant MQLs

Percent of leads receiving at least three touches

Qualitative feedback on message quality and accuracy

Beta cohort invite, portfolio companies wanted

We are opening a limited beta of our Lead Nurturing Agent for venture capital firms that want a measurable value creation initiative. The best fit is a B2B portfolio company with real pipeline, clear ICP, and a mid funnel conversion bottleneck.

What portfolio companies get

Signal based follow up recommendations

Human reviewed drafts aligned to brand voice

A 30 day experiment plan with measurement

Clear onboarding and a lightweight operating cadence

What VCs get

A repeatable portfolio playbook

Documented lifts you can share with future founders

Credibility for future raises built on operational outcomes

Case studies created in partnership with your teams

How to start

Send 2 to 3 portfolio candidates, and we will propose a cohort order, a simple success definition, and a 30 day rollout plan. If you prefer, we can start with a single company first, then expand once the workflow is proven.

FAQ

Is this only a marketing problem

No. Mid funnel conversion sits between marketing and sales. It usually fails because of shared definitions, slow follow up, and lack of a consistent system for relevance and prioritization.

What is the smallest lift that matters

Even a three to five point lift in MQL to SQL can be meaningful, because it increases the number of qualified conversations entering the pipeline.

Will this create noise for prospects

Done right, it reduces noise. Signals are used to make outreach timely and relevant, and humans review drafts before anything is sent.

What data does the system need

At minimum, CRM contact and company fields plus basic lifecycle data. Stronger results come when you add a short list of external signals and a curated proof library.

References

First Page Sage (Oct 3, 2024). “MQL to SQL Conversion Rate By Industry: 2026 Report.” firstpagesage.com/.../mql-to-sql-conversion-rate-by-industry

Oldroyd, J. (MIT). “Lead Response Management Study.” Response time analysis showing odds of contacting a lead in five minutes versus thirty minutes drop by 100 times. cdn2.hubspot.net/.../mit_study.pdf

Lead Response Management Report (MarketingSherpa archive). Qualification odds in five minutes versus thirty minutes drop 21 times. content.marketingsherpa.com/.../LeadResponseManagementReport.pdf

Gartner Press Release (Sep 15, 2020). “Gartner Says 80% of B2B Sales Interactions Between Suppliers and Buyers Will Occur in Digital Channels by 2025.” Includes the stat that buyers spend only 17% of their time meeting with potential suppliers when considering a purchase. gartner.com/.../2020-09-15-gartner-says-80--of-b2b-sales-interactions

Oldroyd, J. B., McElheran, K., Elkington, D. (Mar 2011). “The Short Life of Online Sales Leads.” Harvard Business Review. hbr.org/2011/03/the-short-life-of-online-sales-leads

Jan 12, 2026